Hyundai Corporation Prepares Forklift Business in Australia to Become an Investment Company

Hyundai Corporation plans to pay the required capital within this month while reviewing a plan to acquire a rental company in Australia.

One of Hyundai Corporation’s weakest points is an operating profit margin of less than 1%. Compared with POSCO International, LX International, and other trading firms, the company has yet to create substantial profit generation models other than brokerage commissions.

In order to overcome such a weakness, Hyundai Corporation focuses on turning into an investment firm. To increase the number of income generation models, it is also considering entering the solar panel recycling business after advancing the forklift industry in Australia. Moreover, actively using corporate venture capital (CVC), Hyundai Corporation recently accelerates its efforts to expand its business portfolio.

According to trading business news released on August 16, Hyundai Corporation held a board of directors meeting last June to advance into the forklift industry in Australia, passing a resolution to make an investment worth US$ 2.5 million.

The investment will be used to set up HFA Holdings, a joint venture with HFA, a general agency in Australia for Hyundai Genuine, a sub-holding company for Hyundai Heavy Industries Group in construction machinery. HFA currently operates 16 forklift dealers in Australia. Hyundai Corporation will hold a stake of 50% and secure HFA’s forklift distribution license for Australia after the establishment process is completed.

Hyundai Corporation plans to make inroads into the forklift industry based on this investment scheme more actively. Accumulating its business knowhow, it expects to engage even in forklift rental business in the future. To this end, it is in the process of reviewing a plan to acquire a local rental company.

An official from Hyundai Corporation said, “The required capital will be fully paid within this month. This is part of the efforts to find new growth engines other than trading.”

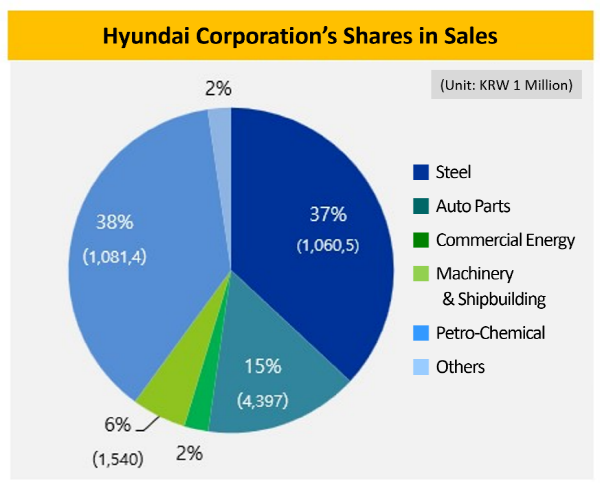

Given its sales structure, the company is deemed to act as a substantial trading company. By the first half of this year, it posted a turnover of KRW 2.8730 trillion, 97.7% of which was generated via trading.

Even though also engaging in resource business for diversification, its share in sales is insignificant (2.3%) enough to be classified as “others” in Hyundai Corporation’s business report.

As a result, Hyundai Corporation’s operating profit margin was estimated to be as low as 1.07% and 1.02% in 2018 and 2019, respectively. It rose to 1.15% in 2020 but fell to 0.93% last year, the lowest level among local trading firms.

It relates to the limitations of trading business. The operating profit margin of trading businesses relying on the massive selling and purchase of commodities is lower than those of other businesses. Excluding ocean freight or various operating expenses, trading companies mostly depending on simple agency business have no choice but to be satisfied with a very small amount of income.

This is why Hyundai Corporation’s competitors have taken a different path from general trading enterprises. For instance, LX International acquired Pantos, a logistics firm, to expand its consolidated operating income while POSCO International made investment in the development of gas fields in Myanmar and generated an operating profit of KRW hundreds of billions.

Recognizing its limitations, Hyundai Corporation has sought ways to change its business structure. At a general shareholders meeting held last year, it was renamed Hyundai Corporation 45 years after it was founded. It also added to its articles of association the following business objectives: automobiles and auto parts manufacturing and distribution; electric parts manufacturing and distribution; eco-friendly materials and composite materials manufacturing and distribution; energy infrastructure (hydrogen and so forth) establishment and related businesses.

Even though dropping out of the project, the company participated in acquiring Shinki Intermobile, an auto parts manufacturer and distributor, last year. This March, it made investment in aeonus, a climate tech startup. In the same month, it added to its articles of association the following business objectives: investment in new tech companies and venture capital and related businesses and waste resources-based eco-friendly recycling and related businesses.

The CVC was also set up in the same vein. This April, Hyundai Corporation invested KRW 11 billion in setting up Prologue Ventures, a CVC, 81.8% and 18.2% of whose stake are owned by Hyundai Corporation and Hyundai Corporation Holdings, respectively. Prologue Ventures invested KRW 5 billion in Armored Fresh, a vegan cheese maker.

In order to overcome the limitations of trading businesses, Hyundai Corporation plans to accelerate its efforts to increase the number of income generation models. To this end, it is in the process of reviewing a plan to advance into solar panel recycling markets in Australia, Japan, and the US.

“Hyundai Corporation will continue to explore new business opportunities. Continuously carrying out the forklift business in Australia, we will review the profitability of solar panel recycling businesses,” said an Hyundai Corporation official.

August 18, 2022, The bell